Welcome To The Data Leak Lawyers Blog

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

It’s important to talk about how the victims who are claiming compensation as part of the BA data class action have been affected.

A lot of the customers who come to us for help have spoken about their concerns when it comes to the loss of control of their personal information. Many have also suffered from fraudulent activity that has happened to accounts linked to the breach.

In reality, there are many ways in which victims can be affected and can be targeted by scammers and criminals who will use the information exposed in the breach to do harm.

The Missoma data breach has a very familiar feel to it. In fact, it feels identical to a number of previous breaches, including compensation actions we’re involved with.

Reportedly, an email sent to customers has confirmed that a data breach has taken place and that malicious software from a third-party had been used to target customers’ payment details. It appears that malicious code has been injected into the payments part of the website in order to steal data processed through it.

Although news of the breach has only just broken, the circumstances surrounding the incident appear to be exactly the same as a number of other data breaches that have taken place in recent years as well.

NHS data breaches and technology can go hand-in-hand. A lot of the incidents that we take forward for both individual cases and group action / multi-party claims often involve technology issues.

One of the most common types of cases that we take forward are NHS data breach compensation claims. Not only can they be common, but the impact for the victims – given how personal and sensitive medical data is – can usually mean that they suffer significant distress. That’s why our work to fight for the rights of the victims is so important.

We’re involved with more than one infamous group legal action as well as countless individual claims for medical data breaches. If you have been affected by an NHS data breach, we may be able to help you as well.

Serious concerns have been raised over security issues that could lead to smart toy data breaches and children being at risk of contact from strangers or exposure to explicit content.

Consumer group Which? has reportedly identified serious security flaws in a number of smart toys that could lead them to being hacked or interfered with. They’re now calling on big name retailers like Amazon, Argos, John Lewis and Smyths to withdraw some “intelligent” and “connected” toys for sale this Christmas. They’re also calling on the government to introduce mandatory security standards for smart toy manufacturers.

We’ve talked in the past about the dangers of smart toys and the “Internet of Things” as greater connectivity opens more doorways for cybercriminals. In the run up to the festive season, the consumer group’s findings are set to cause justifiable concern.

When it comes to avoiding what can be incredibly damaging healthcare information data breaches, prevention over reaction is absolutely key.

In fact, just this morning, we’ve heard about the Labour Party reportedly being hit by a “large and sophisticated cyber-attack”. Our understanding is that the attack on its digital platforms failed, and the reason for the failure is reportedly due to the party’s “robust security systems”.

So, there you have it. Just as we’re about to give you our expert advice about the need for the healthcare sector to focus on prevention, we have just seen what may be the perfect example to compare it to. The long and short of it all is that all organisations must take all reasonable steps to ensure their cybersecurity is robust in order to prevent events taking place.

We’ve said before that a part of the reason that we’re involved in the Group Action for the BA data protection breach is because we believe that the case for compensation is strong.

That’s why we have dedicated a great deal of our time and resources to the action. We have been fighting for the rights of those affected by the BA data breach, working tirelessly on a No Win, No Fee basis for our valued clients.

We’ve talked a lot about how better data protection practices and more robust security could have prevented this breach. We’ve also talked about the fact that GDPR and earlier breaches like the Equifax hack and the Ticketmaster breach should have been warning enough for British Airways to have taken action. Had they have taken action, they could have prevented this colossal incident. And doing so could have been very simple, and incredibly cost-effective.

According to credit-reference agency Experian, there are increasing incidents of fraudsters targeting first-time buyers, and some of it can be related to data breaches.

As a firm of expert data breach compensation lawyers, this news doesn’t come as a surprise to us at all. First-time buyers can be vulnerable to the kinds of tricks and scams that criminals can pull off, particularly because of being thrown into the world of owning a home for the first time. Criminals could pose as a number of organisations or parties, and they could use information from data breaches to convince people that they’re the real deal.

This kind of problem demonstrates how bad a simple data breach can actually be for a victim when criminals use even small bits of seemingly “harmless” data that has been exposed in a breach to do serious damage.

People asking whether they should be worried about a data breach is somewhat of a common question in today’s age of almost continual leaks and hacks.

In some ways, our society has become a bit numb to news of yet another breach hitting the headlines given how common they are. Whilst we don’t want to panic people, it’s important for us to shed some light on the dark side of the internet and explain why people should be worried when they fall victim to a data breach incident.

It’s also important to know what rights you have when it comes to compensation. When you understand about what can happen to your valuable information, it can be distressing.

It probably sounds rather obvious that NHS cybersecurity can be a matter for life and death, but when it comes to data breach compensation claims, medical incidents are still one of the most common.

You would therefore think that it should be an absolute priority, but as more and more of the healthcare system becomes digitalised, there can be more doorways for hackers to get in. At the same time, the healthcare sector is an obvious target given the wealth of personal and sensitive information that’s stored and processed within it.

Victims of a healthcare cybersecurity incident can be entitled to make a claim for medical data breach compensation. But we cannot ignore the fact that such incidents can mean physical harm to patients as well, and then it’s more than a case for the distress caused by the loss of control of private information.

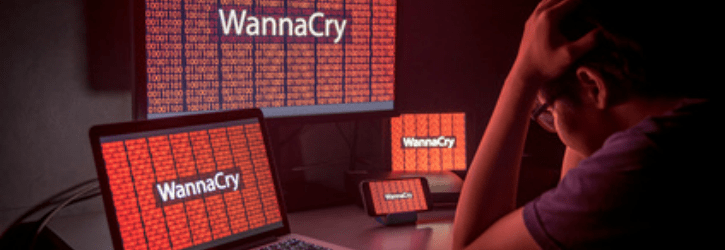

Cyber hack compensation claims are one of the more common types of cases that we represent people for, particularly when it comes to group and multi-party actions.

You can be entitled to claim damages for any distress, suffering, loss of amenity, and for any financial losses as well. Importantly, you don’t have to have suffered an actual financial loss to be able to claim. The mere fact that your information has been hacked can be enough for you to claim for the distress element alone.

Our lawyers are fighting for justice in dozens of different group cases, and many of them have stemmed from cyberattacks.

EasyJet admits data of nine million hacked

British Airways data breach: How to claim up to £6,000 compensation

Are you owed £5,000 for the Virgin Media data breach?

Virgin Media faces £4.5 BILLION in compensation payouts

BA customers given final deadline to claim compensation for data breach

Shoppers slam Morrisons after loyalty points stolen

Half a million customers can sue BA over huge data breach

Lawyers accuse BA of 'swerving responsibility' for data breach

The biggest data breaches of 2020

Fill out our quick call back form below and we'll contact you when you're ready to talk to us.