Welcome To The Data Leak Lawyers Blog

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

The Travelex cyberattack has left customers frustrated as hackers have locked down their systems and are holding the company to ransom.

We’re taking legal action for the previous Travelex incident, which stemmed from a leak of customer data. As an expert consumer law firm that specialises in data breach compensation, we’ve spoken to the media about this incident and aired our concerns that we’re seeing yet another cyberattack incident taking place; this being one of many that have hit various businesses over the last few years.

This hack may lead to customer information being leaked or sold on for money, so there’s every reason for customers to be concerned; despite assurances from Travelex.

We often see mobile apps cybersecurity issues and events in the news. As the use of apps and mobile technology continues to grow, we fear there may be more incidents to come.

And some of those incidents could lead to a great deal of data being exposed or misused for a lot of people; perhaps even millions in a single event.

As data breach compensation experts, we often deal with cybersecurity compensation claims, and many stem from apps. This includes the We-Vibe group action we’re representing victims for, which saw particularly personal and sensitive data for thousands of people misused. We can represent victims for cases on a No Win, No Fee basis, and we’re always happy to offer no-obligation advice.

We have previously discussed the issues surrounding gaming data breaches, and have been asked for help and representation for cases of this nature.

The market for online gaming is massive, and data will be exchanged across the world as part of activities players are engaged in. There will be a lot of accounts that contain a great deal of personal data, and there will also be financial information stored for processing payments.

There’s also a huge “black market” for hijacked accounts as well. There are the players whose accounts they have spent time and money on being stolen, and there are those who are prepared to pay for built-up accounts. This leaves serious questions over the future of gaming and how they may be affected by data breaches.

When it comes to hospital cyber-attacks, our focus is on ensuring that the victims’ voices are heard and that they have the chance for the justice that they deserve.

The threat that hospitals are facing from cybercriminals is substantial. A large volume of the individual compensation claims that we take forward are for medical data breach incidents, and many of them stem from cybersecurity events.

The 2017 WannaCry incident was perhaps one of the biggest examples that showed just how much of a target the healthcare sector really is.

The Missoma data breach has a very familiar feel to it. In fact, it feels identical to a number of previous breaches, including compensation actions we’re involved with.

Reportedly, an email sent to customers has confirmed that a data breach has taken place and that malicious software from a third-party had been used to target customers’ payment details. It appears that malicious code has been injected into the payments part of the website in order to steal data processed through it.

Although news of the breach has only just broken, the circumstances surrounding the incident appear to be exactly the same as a number of other data breaches that have taken place in recent years as well.

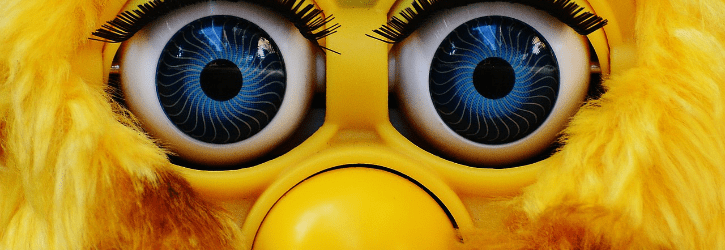

Serious concerns have been raised over security issues that could lead to smart toy data breaches and children being at risk of contact from strangers or exposure to explicit content.

Consumer group Which? has reportedly identified serious security flaws in a number of smart toys that could lead them to being hacked or interfered with. They’re now calling on big name retailers like Amazon, Argos, John Lewis and Smyths to withdraw some “intelligent” and “connected” toys for sale this Christmas. They’re also calling on the government to introduce mandatory security standards for smart toy manufacturers.

We’ve talked in the past about the dangers of smart toys and the “Internet of Things” as greater connectivity opens more doorways for cybercriminals. In the run up to the festive season, the consumer group’s findings are set to cause justifiable concern.

The Sweaty Betty data breach incident appears to be another case of cybercriminals using malicious code in checkout systems to steal sensitive information.

We’ve literally seen this before. Two of the big recent examples are British Airways and Ticketmaster; both of which are thought to be attacks carried out by the same group of hackers. Inserting code into checkout systems can lead to personal details and payment card data being exposed and that’s exactly what has happened in the Sweaty Betty case.

Anyone who has been affected in England and Wales may be entitled to bring a claim for data breach compensation, and we can help.

As a ‘go-to’ name in the data breach compensation industry, we were asked by the I Paper to provide them with a list of Black Friday cybersecurity tips. We were more than happy to help.

As featured in the I Paper today, we have provided a list of safety tips for shoppers this Black Friday which also applies to the coming Cyber Monday. As great as deals can be for shoppers, in today’s age of cyberattacks and data exposure, consumers need to be careful.

You can read the tips in today’s print edition of the I Paper. We’ll also outline the basis of the information for you here as well under headings with some additional information.

We’re now coming up to two months since the British Airways data class action was formalised here in the UK, but if you’re not sure exactly what it is, read on for more information.

As you may already be aware, there were two huge cyber incidents last year involving the airline. The biggest one was announced in September 2018 shortly after its discovery, and as a GDPR breach, claims for compensation for victims could go forward. We started taking cases on right away and have been accepting new claims ever since.

With there being thousands of people signed up with different law firms who are all essentially claiming on similar grounds, the BA Group Action was formed. Here’s how, and what it entails.

When it comes to avoiding what can be incredibly damaging healthcare information data breaches, prevention over reaction is absolutely key.

In fact, just this morning, we’ve heard about the Labour Party reportedly being hit by a “large and sophisticated cyber-attack”. Our understanding is that the attack on its digital platforms failed, and the reason for the failure is reportedly due to the party’s “robust security systems”.

So, there you have it. Just as we’re about to give you our expert advice about the need for the healthcare sector to focus on prevention, we have just seen what may be the perfect example to compare it to. The long and short of it all is that all organisations must take all reasonable steps to ensure their cybersecurity is robust in order to prevent events taking place.

EasyJet admits data of nine million hacked

British Airways data breach: How to claim up to £6,000 compensation

Are you owed £5,000 for the Virgin Media data breach?

Virgin Media faces £4.5 BILLION in compensation payouts

BA customers given final deadline to claim compensation for data breach

Shoppers slam Morrisons after loyalty points stolen

Half a million customers can sue BA over huge data breach

Lawyers accuse BA of 'swerving responsibility' for data breach

The biggest data breaches of 2020

Fill out our quick call back form below and we'll contact you when you're ready to talk to us.